In recent posts we've learned about the The Theory of Decreasing Responsibility as well as the high premiums for permanent insurance. In the following short video by Dave Ramsey, we see an example of how the concept of "Buy Term And Invest The Difference" can help someone become "self insured." I will show a simpler example explaining all of the numbers, below the video, for those interested in how this concept actually works.

I really like Dave and his videos. In this video though, he doesn't explain the investing part in great detail and it sort of seems as though the family magically makes all of this money simply because it invested. In the following calculations I will show, with evidence how someone can become "self insured" using the Buy Term and Invest the Difference concept.

Let's look at an example of a 35 year old male with an insurance need of $500,000.

I ran a quote for whole lfe insurance from an online Canadian insurance brokerage and came up with the following results:

Let's look at an example of a 35 year old male with an insurance need of $500,000.

I ran a quote for whole lfe insurance from an online Canadian insurance brokerage and came up with the following results:

For calculation purposes let's take the third option down - a "Traditional Life Whole Life L100" policy from Industrial Alliance - for $285.30/mo. A very good level premium, $500,000 30 year term policy will cost this same individual $60.33/mo. If this individual chooses the term option over the whole life option, that leaves a "difference" of almost $225/mo ($285.30 - $60.33 = $224.97)

Next, we will use a free online compound interest calculator to see what could happen to that $225 if it were invested.

Next, we will use a free online compound interest calculator to see what could happen to that $225 if it were invested.

If you enter these details in exactly as I have you will find that in 30 years, this man's investment value will be more than $500,000. That would make him self insured and eliminate the need for the term policy.

There are a few assumptions I have made that I would like to point out here though. First, I have assumed that a 35 year old making in excess of $40,000/yr can manage to show enough personal restraint to have saved up $5000 at this point in his life. Second, I have assumed that over a 30 year time frame his income will increase somewhat and he will be able to afford a slightly increased monthly investment amount each year to protect this investment against inflation. If this isn't the case, it would simply take 35 years (instead of 30) for his investment to exceed $500,000 in value (run the case with $0 for the initial investment and uncheck the inflation box for yourself to varify my claim).

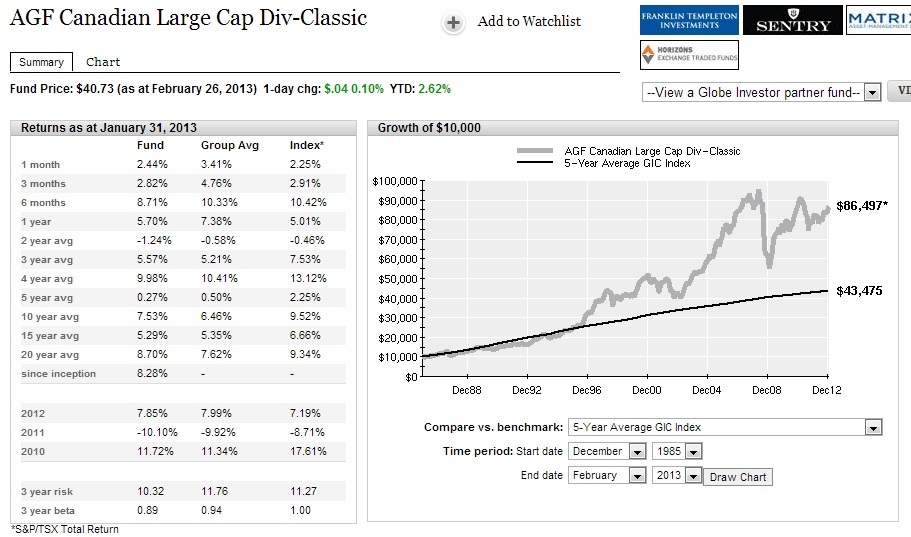

Now, at this point, the most logical question becomes "where can you get an 8% return?" The banks certainly aren't giving people savings accounts or GICs at that rate, and to make matters worse they tell people investing is "risky". I have, however, found an actual investment which has averaged 8% growth a year over the last 26 years. Certainly past performance is no indicator of future results, but it's the best we have to go on, and 26 years is a pretty long time frame so I think we can be fairly confident with using this fund as a benchmark of sorts.

There are a few assumptions I have made that I would like to point out here though. First, I have assumed that a 35 year old making in excess of $40,000/yr can manage to show enough personal restraint to have saved up $5000 at this point in his life. Second, I have assumed that over a 30 year time frame his income will increase somewhat and he will be able to afford a slightly increased monthly investment amount each year to protect this investment against inflation. If this isn't the case, it would simply take 35 years (instead of 30) for his investment to exceed $500,000 in value (run the case with $0 for the initial investment and uncheck the inflation box for yourself to varify my claim).

Now, at this point, the most logical question becomes "where can you get an 8% return?" The banks certainly aren't giving people savings accounts or GICs at that rate, and to make matters worse they tell people investing is "risky". I have, however, found an actual investment which has averaged 8% growth a year over the last 26 years. Certainly past performance is no indicator of future results, but it's the best we have to go on, and 26 years is a pretty long time frame so I think we can be fairly confident with using this fund as a benchmark of sorts.

The above screen shot was from the fund profile of this AGF mutual fund from the Globe and Mail's website, taken on the day I posted this article. AGF is a very old and reputable company, and the fund was started December of 1985 (more than 26 years ago). I have included a comparison of this fund's long term performance against the average growth of a 5-year bank GIC. You can see in the left hand column that, since inception, this fund has averaged 8.28% growth per year. It even managed to average more than a 7% per year return during the extremely volatile last 10 years. This is not to say that I am personally recommending this fund. I am only showing it as an example of what is possible, and as an example of what the banks and insurance companies don't want you to know.

RSS Feed

RSS Feed