How many times have you heard the statement "it takes money to make money?" I bet you've heard it so often you can say it backwards in your sleep. Well, it may be true, but this touching story below will prove that it doesn't take as much money as you think.

0 Comments

If you've been keeping up with your reading on Finding North the past ouple of weeks, then certainly you've noticed that I'm a big fan of saving. My friends know this and the other day one of them asked, "how much should I start saving every month?" My answer was, "anything!" I wasn't joking either. People worry about the interest rate on their investments, when they don't even have anything in their investment at all. That said, for those of you who are curious, I took the liberty of adding the basic compound interest calculator below so anyone interested can see how saving even a little bit each month can really add up over time. Hint: If you don't know what to put for Interest Rate, then try this. If you're saving for something within the next 5 years use an interest rate of about 2% or 3%. For goals ranging 5-12 years in the future, use a 5% or 6% interest rate, and for anything over 12 years, you can try 7% to 8%. That will give you a fairly safe, conservative estimate. Compound Interest Calculator

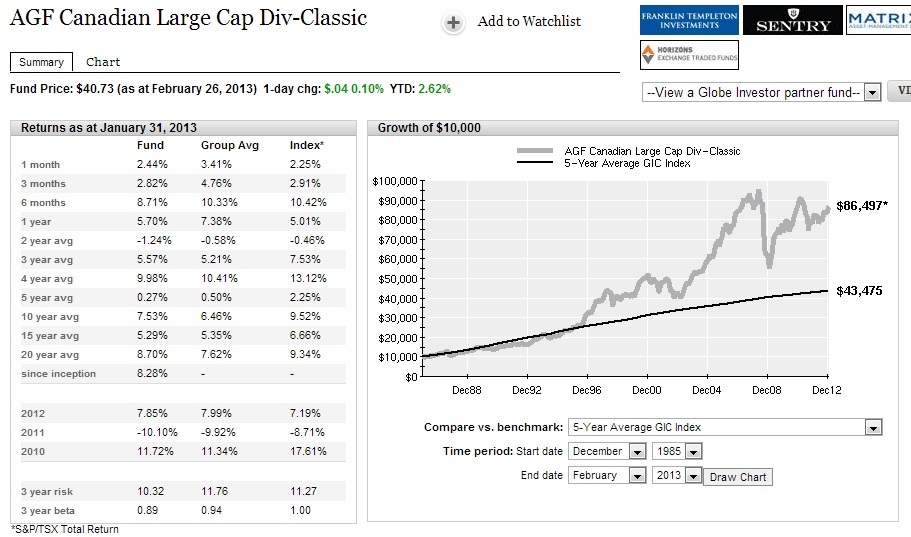

What is a TFSA? How does it work? How is it different from a RRSP? These are all qustions I get on a regular basis, and that should be answered pretty well by this post. The first video is a little hard to see visually, but if you listen to the explanation and follow along with the pen motions you should be able to get the essential information. The second video is for those who need a visual representation/analogy and who also like humour in their finance videos. In my previous post I talked about a mutual fund that had averaged a rate of growth of more than 8% per year. It occured to me that some people might not understand what a mutual fund is or why it is beneficial to have one. Here's a quick history and description of mutual funds. Mutual Funds gained a lot of popularity in the 1980s and 1990s, and now roughly one in three Canadians owns a mutual fund. However, pooled investments (many investors putting their money in a single "pool") have been around for more than 120 years, and the first modern mutual fund was actually created in 1924. But what exactly is a mutual fund? Most of the descriptions I've found are either boring or they use complex financial terms. The video below is short and simple, but it does the clearest job of describing the basic idea behind the concept of a mutual fund. Enjoy. In recent posts we've learned about the The Theory of Decreasing Responsibility as well as the high premiums for permanent insurance. In the following short video by Dave Ramsey, we see an example of how the concept of "Buy Term And Invest The Difference" can help someone become "self insured." I will show a simpler example explaining all of the numbers, below the video, for those interested in how this concept actually works. I really like Dave and his videos. In this video though, he doesn't explain the investing part in great detail and it sort of seems as though the family magically makes all of this money simply because it invested. In the following calculations I will show, with evidence how someone can become "self insured" using the Buy Term and Invest the Difference concept. Let's look at an example of a 35 year old male with an insurance need of $500,000. I ran a quote for whole lfe insurance from an online Canadian insurance brokerage and came up with the following results: For calculation purposes let's take the third option down - a "Traditional Life Whole Life L100" policy from Industrial Alliance - for $285.30/mo. A very good level premium, $500,000 30 year term policy will cost this same individual $60.33/mo. If this individual chooses the term option over the whole life option, that leaves a "difference" of almost $225/mo ($285.30 - $60.33 = $224.97) Next, we will use a free online compound interest calculator to see what could happen to that $225 if it were invested. If you enter these details in exactly as I have you will find that in 30 years, this man's investment value will be more than $500,000. That would make him self insured and eliminate the need for the term policy. There are a few assumptions I have made that I would like to point out here though. First, I have assumed that a 35 year old making in excess of $40,000/yr can manage to show enough personal restraint to have saved up $5000 at this point in his life. Second, I have assumed that over a 30 year time frame his income will increase somewhat and he will be able to afford a slightly increased monthly investment amount each year to protect this investment against inflation. If this isn't the case, it would simply take 35 years (instead of 30) for his investment to exceed $500,000 in value (run the case with $0 for the initial investment and uncheck the inflation box for yourself to varify my claim). Now, at this point, the most logical question becomes "where can you get an 8% return?" The banks certainly aren't giving people savings accounts or GICs at that rate, and to make matters worse they tell people investing is "risky". I have, however, found an actual investment which has averaged 8% growth a year over the last 26 years. Certainly past performance is no indicator of future results, but it's the best we have to go on, and 26 years is a pretty long time frame so I think we can be fairly confident with using this fund as a benchmark of sorts. The above screen shot was from the fund profile of this AGF mutual fund from the Globe and Mail's website, taken on the day I posted this article. AGF is a very old and reputable company, and the fund was started December of 1985 (more than 26 years ago). I have included a comparison of this fund's long term performance against the average growth of a 5-year bank GIC. You can see in the left hand column that, since inception, this fund has averaged 8.28% growth per year. It even managed to average more than a 7% per year return during the extremely volatile last 10 years. This is not to say that I am personally recommending this fund. I am only showing it as an example of what is possible, and as an example of what the banks and insurance companies don't want you to know. If you're like most people (including me) you've probably heard that investing is risky, or that you can lose your money in the stock market. I will tackle these two common misconceptions in the future, but for now let's assume that this is true since most peope perceive it to be true anyway. The concept that changed my life when I first heard it and allowed me to imagine myself as an investor was the concept of Dollar Cost Averaging. While it is not a miracle cure for low returns or a guarantee of positive gains on your investments, it does allow you to increase your chances of making a profit even when the price of stocks are fluctuating up and down. In today's video Judy Schrempf, owner of Financial Health Club, teaches us about this powerful concept and how it can help you invest with less stress. When I ask my friends and family members what the interest rate on their RRSPs are, they'll typically quote me whatever the bank has advertised (e.g., 2.1%). The problem with this answer is that RRSPs are not actually an investment you can buy. They don't produce a rate of return or have an interest rate. They are government created tax shelters into which you can place investments. In the video below, Brad and Andrew from Bumstead Financial Services in Vancouver explain very well what a RRSP is. It's a very important concept, so below the video I will highlight some of the points that I think make the RRSP such a great savings tool but that I also think are misunderstood by most Canadians. Important Points: 1) It costs the Government of Canada BIG money when people can't take care of themselves during retirement. As a result, it started giving Canadians a "tax loan" so that there would be an incentive for them to save some money on their own. When you put money in to a RRSP, the government loans you back the taxes you paid on that money until you take it back out of the RRSP, at which time they tax you at whatever rate you are at that time. 2) My father once purchased a GIC for me. He did not register it in a RRSP. Rather, it was left as an open or "unregistered" investment. Every year I had the GIC, the government would send me a T5 that said how much intrerest my GIC had earned that year. I then had to register that amount on my income tax form and pay the appropriate taxes on the growth of my investment. It wasn't very nice. However, if my father had put it in a registered tax shelter (like a RRSP) the government would not have taxed me on the growth of the GIC while it was in the RRSP. Furthermore, some mutual funds trigger various additional taxes depending on what happens inside the fund. These are charged to the fundholder (i.e., you), but not if it is in a RRSP. This tax sheltering feature is a major advantage of saving inside a RRSP. 3) When people think their RRSP returns 2.1%, it's not the RRSP that returns 2.1%, it's the GIC or savings account the bank put inside for you so that it could make a lot of money with your money, but tricked you into thinking was actually just what RRSPs make. As Brad explains, you can put almost any kind of investment, including a mortgage, into a RRSP and it will return whatever that investment returns. Come to think of it, what's a bear market too? If you've tried even briefly to understand the stock market you've probably heard one or both of these terms. To expain it as simply as possible I've engaged the help of the following YouTube video from Motley Fool co-founder, David Gardner. Yesterday we learned what it means to purchase stock in a company, today we'll discuss another common aspect of a diversified portfolio - bonds. This is a very short and simple video so as always, if you have any questions, post them in the comments section below and I will be sure to address them in future posts. We're going to be talking a lot about investing and the stock market in this blog, so I thought it would be useful for everyone to understand what exactly happens when an individual or a mutual fund buys shares of a company (buys stocks). There doesn't seem to be a simple way to explain this completely, but this video by MIT and Harvard business school graduate, Salman Khan, is the best explanation I could find. I hope that video was helpful. If anything wasn't clear, or you have any questions or comments, please write them in the comments section and I will try and find a different video to address the concern. Cheers, Dave "The Money Guy" | |||||||||||||||

| Finding North |

|

RSS Feed

RSS Feed