In my previous post I talked about a mutual fund that had averaged a rate of growth of more than 8% per year. It occured to me that some people might not understand what a mutual fund is or why it is beneficial to have one. Here's a quick history and description of mutual funds. Mutual Funds gained a lot of popularity in the 1980s and 1990s, and now roughly one in three Canadians owns a mutual fund. However, pooled investments (many investors putting their money in a single "pool") have been around for more than 120 years, and the first modern mutual fund was actually created in 1924. But what exactly is a mutual fund? Most of the descriptions I've found are either boring or they use complex financial terms. The video below is short and simple, but it does the clearest job of describing the basic idea behind the concept of a mutual fund. Enjoy.

In recent posts we've learned about the The Theory of Decreasing Responsibility as well as the high premiums for permanent insurance. In the following short video by Dave Ramsey, we see an example of how the concept of "Buy Term And Invest The Difference" can help someone become "self insured." I will show a simpler example explaining all of the numbers, below the video, for those interested in how this concept actually works. I really like Dave and his videos. In this video though, he doesn't explain the investing part in great detail and it sort of seems as though the family magically makes all of this money simply because it invested. In the following calculations I will show, with evidence how someone can become "self insured" using the Buy Term and Invest the Difference concept. Let's look at an example of a 35 year old male with an insurance need of $500,000. I ran a quote for whole lfe insurance from an online Canadian insurance brokerage and came up with the following results: For calculation purposes let's take the third option down - a "Traditional Life Whole Life L100" policy from Industrial Alliance - for $285.30/mo. A very good level premium, $500,000 30 year term policy will cost this same individual $60.33/mo. If this individual chooses the term option over the whole life option, that leaves a "difference" of almost $225/mo ($285.30 - $60.33 = $224.97) Next, we will use a free online compound interest calculator to see what could happen to that $225 if it were invested. If you enter these details in exactly as I have you will find that in 30 years, this man's investment value will be more than $500,000. That would make him self insured and eliminate the need for the term policy.

There are a few assumptions I have made that I would like to point out here though. First, I have assumed that a 35 year old making in excess of $40,000/yr can manage to show enough personal restraint to have saved up $5000 at this point in his life. Second, I have assumed that over a 30 year time frame his income will increase somewhat and he will be able to afford a slightly increased monthly investment amount each year to protect this investment against inflation. If this isn't the case, it would simply take 35 years (instead of 30) for his investment to exceed $500,000 in value (run the case with $0 for the initial investment and uncheck the inflation box for yourself to varify my claim).

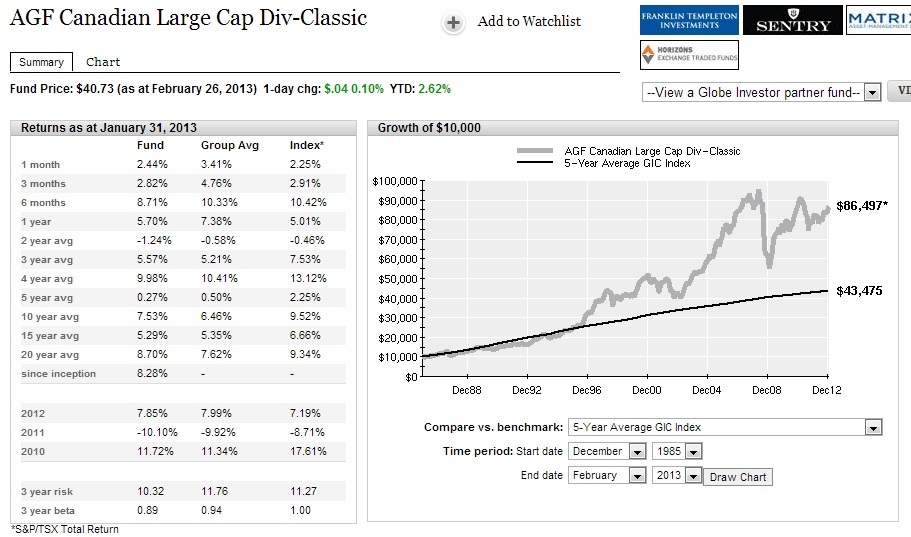

Now, at this point, the most logical question becomes "where can you get an 8% return?" The banks certainly aren't giving people savings accounts or GICs at that rate, and to make matters worse they tell people investing is "risky". I have, however, found an actual investment which has averaged 8% growth a year over the last 26 years. Certainly past performance is no indicator of future results, but it's the best we have to go on, and 26 years is a pretty long time frame so I think we can be fairly confident with using this fund as a benchmark of sorts. The above screen shot was from the fund profile of this AGF mutual fund from the Globe and Mail's website, taken on the day I posted this article. AGF is a very old and reputable company, and the fund was started December of 1985 (more than 26 years ago). I have included a comparison of this fund's long term performance against the average growth of a 5-year bank GIC. You can see in the left hand column that, since inception, this fund has averaged 8.28% growth per year. It even managed to average more than a 7% per year return during the extremely volatile last 10 years. This is not to say that I am personally recommending this fund. I am only showing it as an example of what is possible, and as an example of what the banks and insurance companies don't want you to know.

If you're like most people (including me) you've probably heard that investing is risky, or that you can lose your money in the stock market. I will tackle these two common misconceptions in the future, but for now let's assume that this is true since most peope perceive it to be true anyway. The concept that changed my life when I first heard it and allowed me to imagine myself as an investor was the concept of Dollar Cost Averaging. While it is not a miracle cure for low returns or a guarantee of positive gains on your investments, it does allow you to increase your chances of making a profit even when the price of stocks are fluctuating up and down. In today's video Judy Schrempf, owner of Financial Health Club, teaches us about this powerful concept and how it can help you invest with less stress.

Today's topic is The Theory of Decreasing Responsibility. In my debates with my insurance friends the topic of insurance being a permanent or temporary need typically comes up. I will include an argument for both sides, and then follow up with my analysis. As you can see from the videos, the basic argument for whole life insurance is that as you age insurance becomes more expensive. When your 10, 20, or 30 year term comes to an end, you will have to pay more to renew it again. At some point you may not be able to afford the policy at all. An additional point is that when you try to apply for a new policy at an older age to get a lower rate (many policies are guaranteed renewable but with a higher rate than a new policy would cost), you may have become uninsurable due to health issues since you first applied. The proposed solution is to pay a higher initial premium than you would with a term policy, to gain the benefit of a fixed premium and coverage throughout your entire life (the video refers to this as "peace of mind").

The counterargument to this is that the purpose of life insurance is to provide a big pile of cash for your family in the event that you pass away before you develop a big pile of your own. As we've discussed in previous posts, a typical family needs anywhere from $300,000 to $800,000 or more worth of insurance to meet all final expenses, debt obligations, and provide a lump sum of cash to invest so that the family can use the money to meet its daily expenses after losing the breadwinner's income.

Over time, assuming the family's need was originally $400,000, but its assets/investments now totalled more than $200,000, then the shortfall between what it has and what it needs will have been greatly decreased. Additionally, most of the family's income in the early years is used to pay for liabilities (car loan, mortgage, children, etc.). If the children are at some point gone, and so are the mortgage and car loan, then the need for insurance becomes even further reduced (as does your premium).

One of the easiest ways to accurately calculate how much insurance you need is to use the DIME method. The website Go Ask Newton has a great article explaining this method, but I will also include an example here. The D stands for Death/Debt. Typically I use about $10,000 to $15,000 for final expenses, and add to this whatever consumer debt the family might have. The I stands for Income. I've seen many financial professionals recommend taking the bread winner's yearly income and multiplying it by 10. The M stands for Mortgage. This is an easy one. Just take a look at the remaining balance on the most recent mortgage statement. The E stands for Education. If the family wants to fund its child's/children's post secondary education, consider that a typical university education tuition fee in Canada is at least $4000 or $5000 per year, per child, but could be $8,000/yr or higher depending on the school. Calculate accordingly. In the my post Whole Life vs. Term Insurance, Round 2 I mentioned a 35 year old male looking to protect his family. If this male bread winner had a wife and two children about 5 and 8 years old, as well as a mortgage and some personal debt, his insurance need might be as follows: Debt/Death = $40,000 ($15,000 final expenses + $25,000 in student loans/car loans/credit card debt) Income = $450,000 ($45,000/yr x 10)

Mortgage = $180,000

Education = $40,000 ($5,000/yr x 4 years x 2 children)

If we add all of these values up, we find that the insurance need for this man is $710,000.

The following video featuring Certified Financial Planner, Jeff Rose, discusses some important aspects of determining how much life insurance you actually need. It also highlights yet more reasons why term life insurance is better than whole life insurance, which I will explain after the video. The best and most important point Mr. Rose makes, in my opinion, is that life insurance is all about income replacement, and that being underinsured can leave your loved ones financially devastated. He gives us a very important question to ask ourselves: If I pass away and my working income stops coming in, will my family be okay? Unless your family has an outside income source that is producing the income there will likely be a shortfall between what will be coming in and what needs to be coming in. There are a few ways to calculate how much insurance is needed to cover this shortfall which I will be discusing in detail in a future post. That said, depending on which method you use, if you make $30,000 a year you will need anywhere from $300,000 to $500,000 worth of insurance. If you make $50,000 a year then the need is anywhere from $500,000 to about $800,000 worth of insurance. Using an online insurance quote website, I found that in Nova Scotia, for a healthy 35 year-old male, $300,000 worth of whole life insurance will cost about $185/mo. $500,000 worth of whole life insurance for the same person would cost approximately $300/mo. My experience sitting down with families has taught me that most young couples with children can't afford to spend that much money on their insurance, therefor they end up purchasing less of it and being underinsured. If this man instead purchases an equivalent amount of good, quality term insurance he would only have to pay $33/mo to $41/mo for $300,000 worth of coverage, or $46/mo to $60/mo for $500,000 worth of coverage (depending on the length of the term). The saved money can then be used for other financial needs like saving for the children's education or investing for financial independence. This concept is called " Buy Term and Invest the Difference," and will be discussed in more detail in a future post.

I have many friends in the whole life industry and so I get into the term vs. whole life debate on a regular basis. While I don't take the arguments personally I have found through extensive research that there is absolutely no good reason to ever buy whole life insurance, ever, under any situation. In this video we discuss problem number one: Price. You'll also notice the massive commissions generated which I feel have more to do with the agents recommending whole life than any heartfelt desire to help anyone.

Nobody wants to think about it, but death is inevitable and we never know when it will happen. Unfortunately, that makes life insurance a necessary evil. While life insurance is a rather complicated industry to understand completely (like any area of finance), the following video which I don't necessarily agree with 100%, is well done and will provide a good starting point for further discussion and videos.

|

RSS Feed

RSS Feed